How does the statutory audit process work and how can I prepare?

Statutory Audit Process and Preparation

Most businesses of a certain size are required by law to have a financial audit carried out – but what is the audit process, what should you expect and what do you need to do to prepare for one?

Every chartered accountant/registered auditor will have their own preferred approach, and the overall process may differ depending on the type of business you own. However, there are specific steps in the statutory audit that must to be undertaken to meet the legal requirements.

So, once you’ve appointed an auditor (some advice on that here), what happens next?

The key stages of the statutory financial audit process

Pre-audit agreement

Before the audit itself, your auditor will need to check your anti-money laundering information and ensure you’ve conducted any necessary due diligence. Before the issue and signing of a letter of engagement, details such as the scope and objective of the audit are laid out, along with timescales and the auditor’s fees and the responsibilities of both parties.

Risk assessment and audit plan

Your auditor will create an overview of your previous audit history and any historic issues, your collated accounts, your operational/financial controls/processes and assess any potential concerns. Any identified risks can then be accounted for/noted and a fraud risk calculation will be made e.g. low, medium or high. Planning and performance materiality will be assessed and set, and resources allocated.

Internal financial reporting review

At this stage, your auditor will require access to a variety of documents, such as your financial reporting policies, accounts and financial statements. During this stage, they’ll also be looking to assess whether your internal controls are adequate, or if they’ll need to take a larger sample during the audit to ensure accuracy and validity. Data storage and accounting procedures and systems will also be evaluated.

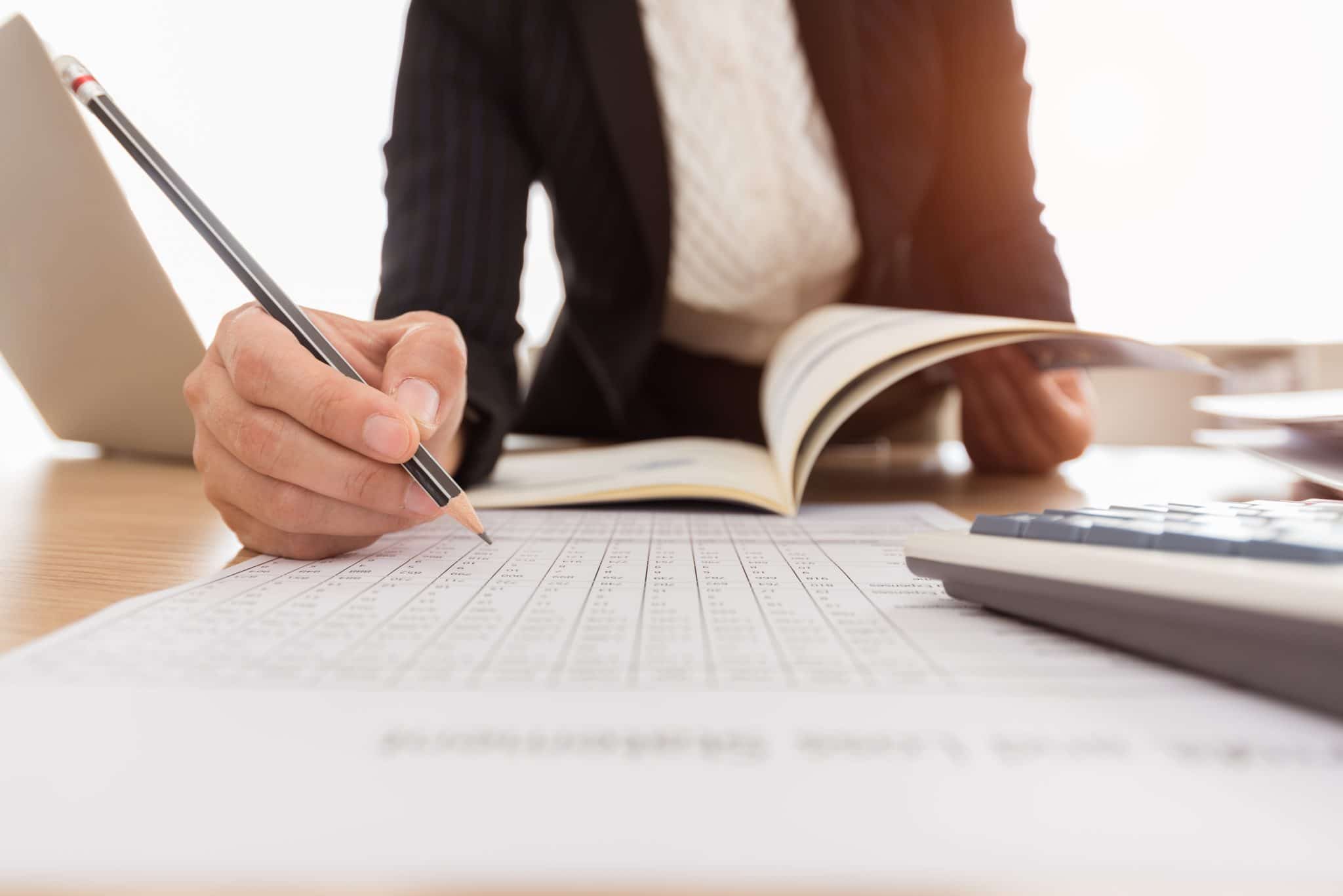

Fieldwork

This comprehensive fieldwork stage is the backbone of your audit: a detailed ‘deep-dive’ into your financials which involves analysis, investigation, calculations and cross-referencing across your data. Your auditor will require access to paperwork/digital data such as invoices, bank statements and contractual agreements, alongside your core accounts. Your auditor may also check your tax records to ensure your returns and payments add up.

Statutory reporting

Once all samples, tests and investigations have been completed, the final step in the audit process is the presentation of results in the form of an audit report. This document will set out the details of the agreement/responsibilities made earlier in the journey, an overview of internal procedures and your audited statements. Your audit report will conclude with your auditor’s overall statement of findings, in the form of an ‘opinion’, which is usually expressed in terms of:

Unmodified opinion . the auditor has concluded that your business financial statements are accurately represented and comply with current standards.

Modified opinion . your auditor’s investigations have revealed material misstatements or there was insufficient evidence to validate accuracy/reliability.

Feedback from the auditor

Following the completion of audit fieldwork, our team prepares an Audit Findings Report. This provides our overall opinion, details of how we have addressed the identified risks, and feedback on any internal control issues identified during the audit. This will benefit you in terms of ensuring a smooth audit process next time, supports you in taking steps to mitigate identified risks and also seeks to create efficiency savings within your business wherever possible. Once the statutory audit is complete, our team is on hand throughout the year to help with ad hoc queries and implementation of any agreed actions.

As mentioned above, the statutory audit process steps will vary a little, but this gives you a good idea of what to expect.

Checklist . How to prepare for your statutory financial audit

Here’s a brief checklist to help you prepare for your statutory financial audit.

Delegate responsibility for overseeing/assisting the audit process to the most appropriate team member(s). Make sure that there’s internal resource to pick up any slack and that there are no clashes between booked leave and the audit timescale.

Communicate with stakeholders/board members where necessary to keep them informed and ensure that they have the opportunity to request any additional investigations they may wish the auditor to conduct.

Gather your data. Once you and your auditor have agreed on scope, you’ll need to collate all required data and documentation ready for them in the agreed format. In a well-oiled accounting team, financial records will be regularly updated and organised, so everything should be pretty much ready to go.

Identify and highlight any transactions that your auditor may flag for being outside of usual parameters and ensure you have any supporting documentation available so they can be easily assessed.

Ask questions! If you’re unsure of any of the audit process steps, what you need to do to support your auditor, or have any other questions, just ask – the process will work much more efficiently if everyone is on the same page.